Want to Master Accounting Without the Stress? Here’s the Fast and Easy Way to Get Started.

Join thousands of students who’ve discovered a faster, smarter way to conquer Business and Accounting concepts.

Start Learning Now Get Instant Access.

You have Nothing To Lose with a 100% Money back no questions asked

If you’ve ever felt overwhelmed by accounting, you’re not alone.

We understand, and we’re here to help.

Hi Colin Burr CEO of learnaccountingfast.com here I am a seasoned professional of 30+ years who ran a multinational drilling company, navigating complex business and financial landscapes across the globe for 15 years.

Despite my business acumen, I found the intricacies of accounting a recurring challenge that hindered seamless decision-making.

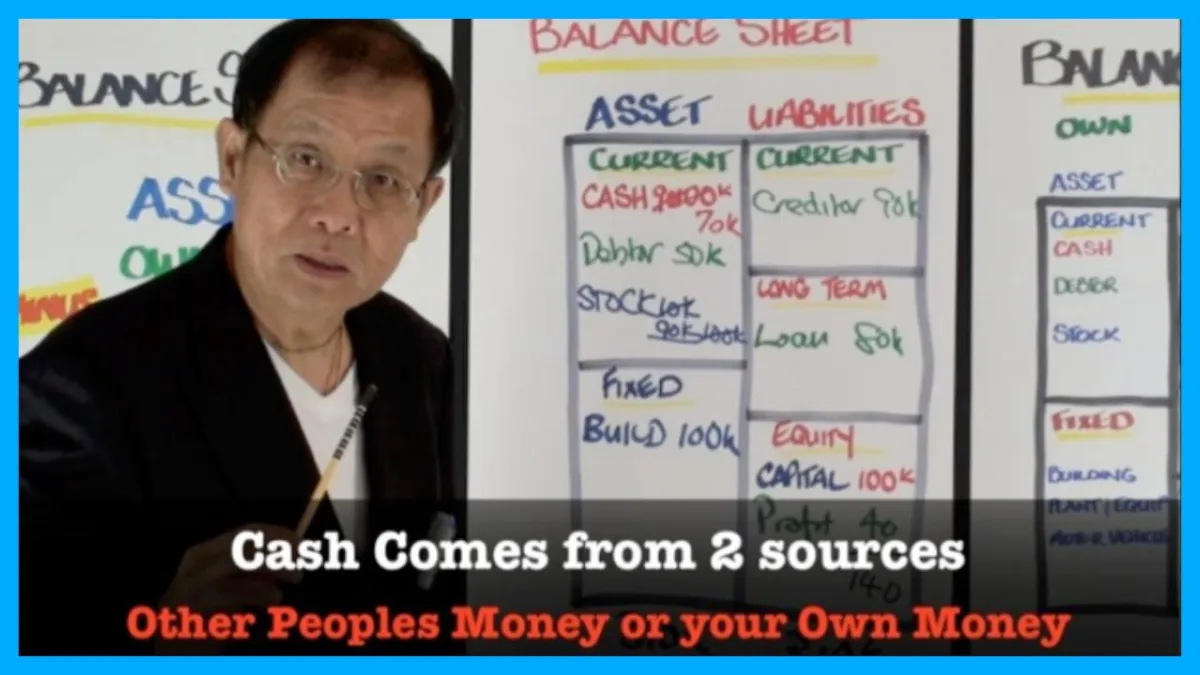

Determined to find a solution, I transitioned from corporate leadership to teaching successful business principles alongside Peter Ho FCCA, ACIS Founder of Nimai and Associates, delivering "Accounting is Easy”

A unique course using accelerated learning methods making learning fun, simple and memorable to the corporate world in Southeast Asia and the Middle East.

In these sessions, we focused on simplifying essential business skills rooted in accounting principles.

Our unique approach wasn’t about turning people into accountants but empowering them to communicate effectively with accountants, enabling sound and successful business decisions.

Drawing from these experiences, We developed the Street Smart Business Skills video series, a proven method that transforms business success confusion into clarity.

We continue to share this method, helping others streamline their understanding of business and accounting to achieve unparalleled confidence and efficiency in their business decisions..

Street Smart Business Skills In Just 4 Hours

Start Learning Now Get Instant Access.

Your Master Facilitator Peter Ho FCCA, ACIS

With Peter, learning business and accounting is not just easy it’s transformative!

For over 20 years, Peter Ho has been a Fortune 500 International Financial Educator, captivating audiences around the globe.

Sharing the stage with iconic speakers like Tony Robbins and marketing legend Jay Abraham, Peter has earned a reputation as a master at simplifying even the most complex business concepts.

Voted the most popular speaker at the National Achievers Conference in Singapore, Peter has a unique talent for breaking down accounting and business principles into such simple terms that even your grandmother could confidently manage a business!

His expertise empowers individuals to boost performance, maximize profits, and improve cash flow with ease.

As a master facilitator, Peter leverages cutting-edge accelerated learning techniques to help you enhance your skills by up to 600%.

5 Simple Steps to Master Business and Accounting in Record Time.

Unlocking Business Accounting Success Made Easy.

Focus on understanding the accounting principles as the foundation of all financial concepts.

Utilize user-friendly templates to simplify calculations and save time.

Divide learning into smaller, digestible bites to avoid overwhelm and improve retention.

Practice real-life scenarios to connect theory with practical application.

Regularly review and reinforce your knowledge to ensure mastery of core principles.

Street Smart Business Secrets In Just 4 Hours

Start Learning Now Get Instant Access.

You have Nothing To Lose with a 100% Money back no questions asked

How Learn Accounting Fast Can Help You Simplify Accounting.

Save hours with our cut to the chase short videos.

Understand accounting basics without confusion.

Gain confidence managing your finances.

Improve communication with your accountant for better financial decisions.

Avoid costly financial mistakes with a clear understanding of key principles.

Make informed business choices that drive growth and success.

Streamline budgeting and forecasting with ease.

Enhance your ability to identify financial opportunities and risks.

Committed to making SUCCESSFUL business principles simple and easy to understand!

This course is one of the best I have ever attended in many years. The business aspect was covered extremely well and forces us to think 'out of the box'. In terms of relevance I would give it a score of 120%

Petronas, Malaysia